Exactly How Underinsured And Without Insurance Driver Coverage Functions

Some auto insurance plan place strict target dates Best lawyer for head-on car accidents when it involves notice of prospective uninsured cases. In general, a without insurance or underinsured chauffeur insurance claim progresses in the same way as a regular vehicle insurance case, except that the claim is submitted with your very own insurance company. Motorists with a tidy driving background pay less than motorists who have website traffic infractions and at-fault automobile mishaps on their documents.

- When the at-fault party has no insurance coverage, you can turn to your own insurance policy for compensation.Losing your certificate makes it hard to get to function, college, or do essential duties.For example, California, Hawaii, Massachusetts and Michigan ban making use of credit history in auto insurance quotes.Around 14 percent of chauffeurs in the U.S. do not have car insurance, according to current information from the Insurance policy Research Study Council.

If you are in a negligence state, your case lies with the at-fault motorist's insurance provider. In such situations, you can either gather from your own insurer if you have an underinsured policy, or sue the at-fault driver. That's true unless the driver doesn't have consent to be driving the auto, or has been particularly excluded from insurance coverage under the car proprietor's plan, or a few other fine print applies. Unless Demetrius has sufficient possessions to react to collection initiatives or to satisfy a court judgment, it's not worth it.

They are regional firms so if they do not serve your area, check quotes from Geico. If auto insurance policy is extending your budget, ask your insurer regarding discount rates you might qualify for and look around to see if you can get a lower rate for the exact same protection from a various provider. Experian's vehicle insurance contrast device can aid you compare rates and discover inexpensive protection.

How Do You Learn If Somebody's Plan Limits Suffice To Cover A Mishap?

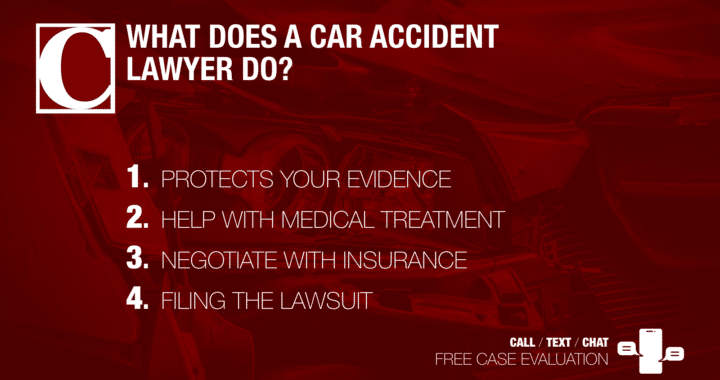

The brief solution is generally of course, full coverage is required if you have a car car loan because maintaining comprehensive and accident protection aids safeguard the lender. Lenders typically call for motorists to maintain both sorts of insurance coverage until the loan is paid off or lease is up. The value of your car, insurance deductible, funds, driving routines and various other aspects can aid you establish whether dropping complete insurance coverage cars and truck insurance policy makes financial sense. It's usually smart for vehicle crash targets to get local legal help. For instance, those that reside in Houston would want to connect to the best vehicle crash lawyers in Houston, Texas.

The Risk Of Being A Without Insurance Driver

However what occurs when your auto crash injury claim goes beyond insurance restrictions? What if your accident caused severe injuries and the damages and losses you have endured are substantial? Discover what happens when an at-fault motorist has no insurance policy, including monetary risks, lawful repercussions, and alternatives for recuperating settlement. Keep in mind that cars and truck insurance plan commonly require you to notify them of a potential insurance claim quickly after the event. Don't delay in consulting with an attorney and calling your insurer.

Whether you're travelling to function, chauffeuring your children around or running tasks, there's a good chance you're sharing the road with chauffeurs who don't have vehicle insurance coverage. When accidents happen in an at-fault state, the insurance providers of both events evaluate the information and make a judgment pertaining to which motorist should be called to account. Depending on the details of the crash, the process of determining that is or is not to blame in an accident can be uncomplicated or very complicated. You might potentially be held responsible for discomfort and suffering or long term loss of revenue as well, so it is crucial that you have enough obligation insurance policy to cover these costs. In many locations, driving without insurance coverage can result in losing your motorist's certificate.